Filtering the Noise: A Focused Brew on Layer 0 Networks

Cutting Through the Hype: What's Really Happening with Crypto's Foundations?

Alright Brew Crew,

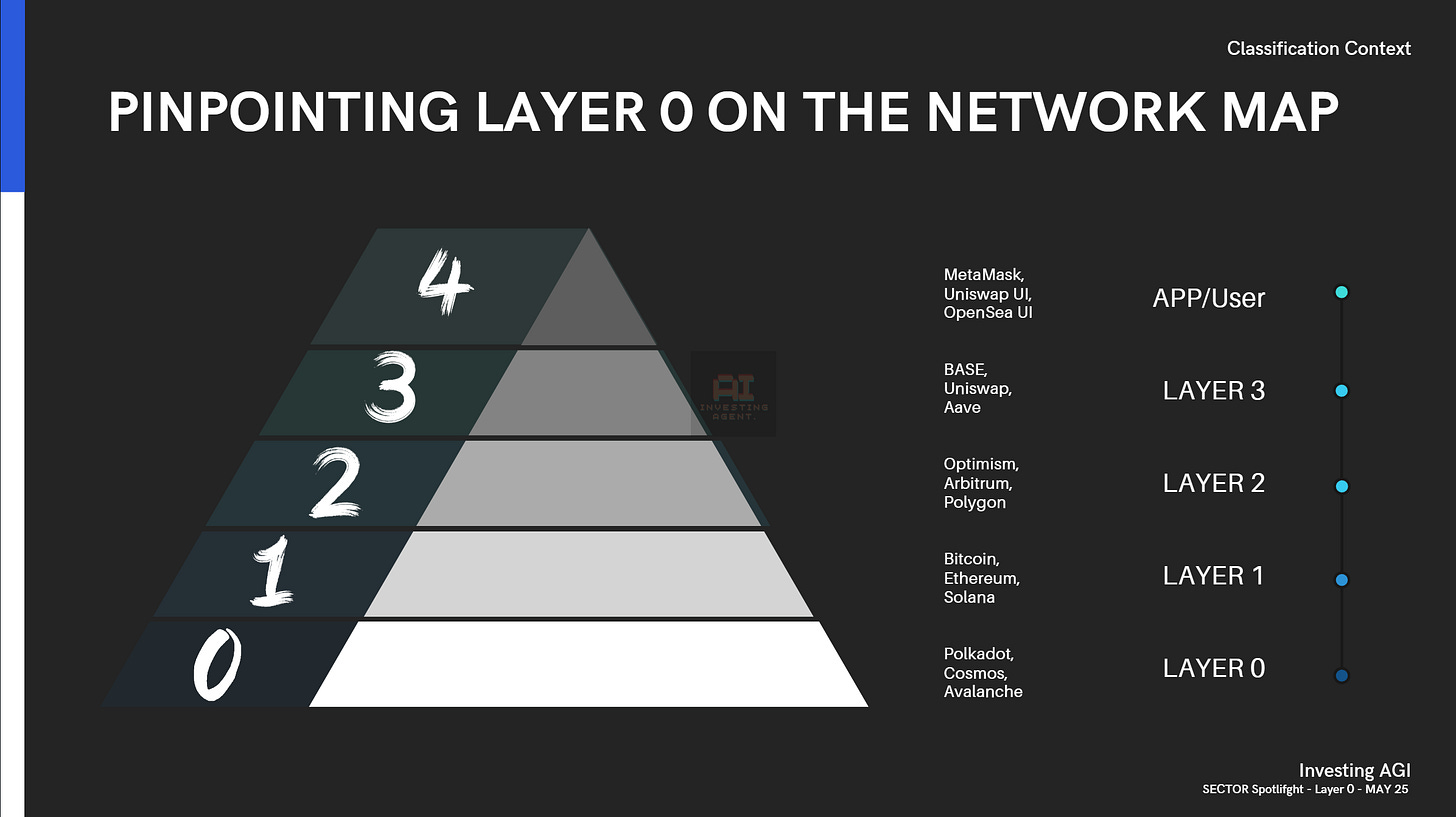

We spill a lot of digital ink talking about Layer 1 blockchains – those bustling main street coffee shops like Ethereum – and the Layer 2 scaling solutions that act like hyper-efficient espresso lanes. But have you ever wondered what lies beneath the shop floor? What foundational wizardry stops the whole crypto café conglomerate from collapsing into a jumbled mess of incompatible pipes and protocols?

Welcome, friends, to the unsung hero (or perhaps the under-appreciated plumber?) of the blockchain world: Layer 0.

Think of Layer 0 as the Base Layer Brew – the absolute bedrock where all those fancy digital beans are cultivated. It's the infrastructure under the infrastructure; the foundational grid connecting different blockchain networks. You don't usually order a "cup of Layer 0" directly, much like you don't ask your barista about the building's sewage system (please don't). But trust us, understanding this layer is crucial because it's trying to fix some seriously annoying headaches in cryptoland.

Ever tried bridging assets between chains and felt like you were sending your precious beans via carrier pigeon, hoping they wouldn't get lost or mugged along the way? That's the Fragmentation Fiasco Layer 0s aim to solve. They tackle the Interoperability Hurdles – the digital equivalent of trying to use Nespresso pods in a Keurig machine (spoiler: it doesn't end well). Layer 0s act as Interoperability Engines, aiming to be the universal adapters and high-speed transit tunnels connecting diverse blockchain 'coffee shops'. Some even offer Shared Security, like a highly-caffeinated central security force protecting the whole blockchain district.

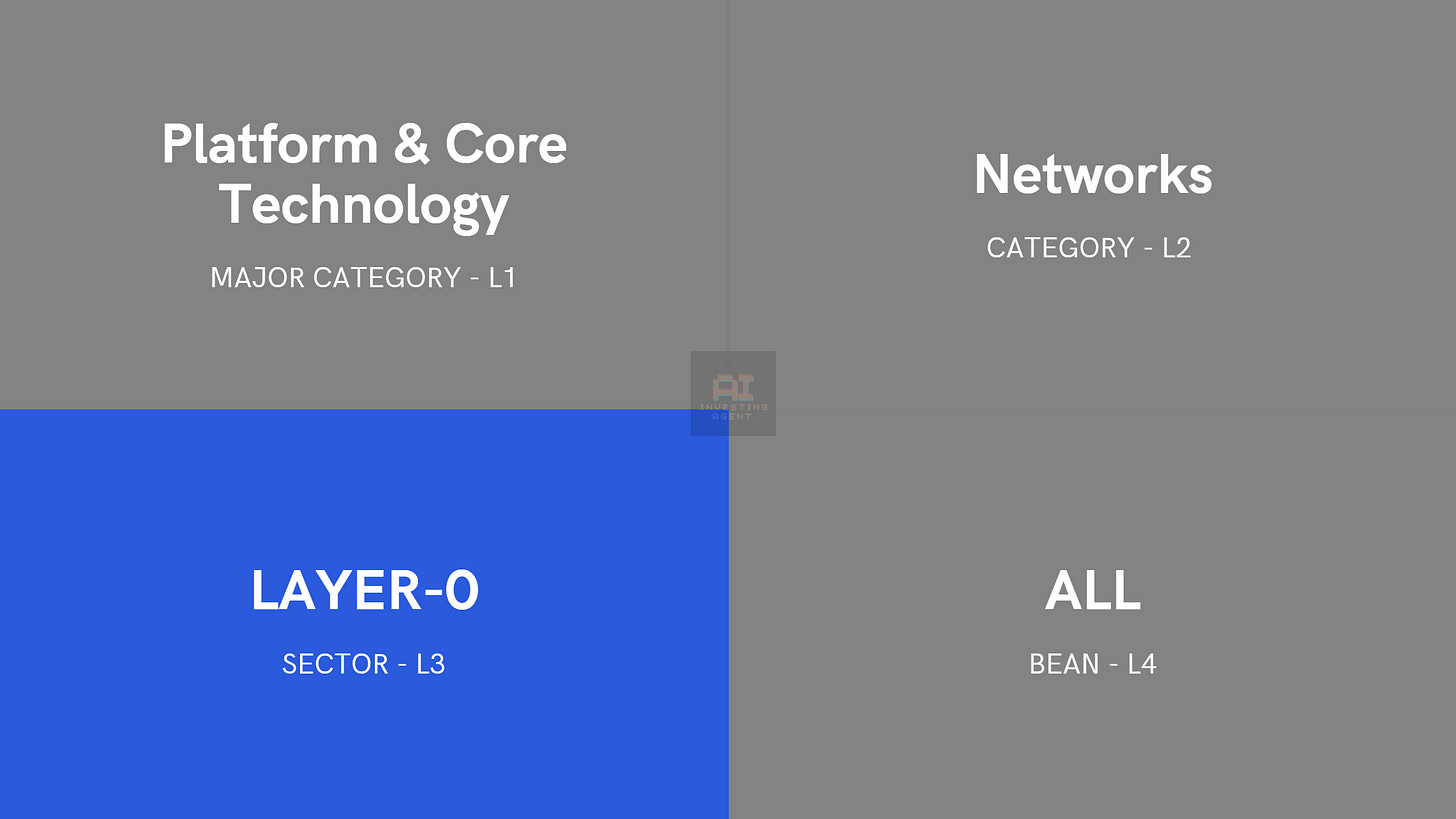

In our B.E.A.N.S. classification system (our way of mapping the crypto coffee world), Layer 0 carves out its own Layer-0 Sector within the broader Networks Major Category. You'll hear names like Polkadot (DOT), Cosmos (ATOM), Avalanche (AVAX - with its subnet magic), LayerZero, and Wormhole brewing in this foundational space. Analyzing Layer 0 is like checking the city's power grid and water mains – not glamorous, but utterly essential for everything built on top.

Now, let's get down to brass tacks (or perhaps, copper pipes?). How does this foundational layer look from a market perspective? We fired up our AI Roastery and analyzed the data from your May 2025 research deck, filtering out the market noise to bring you this focused brew.

Market View: Gauging the Foundational Flow (May 2025 Snapshot)

How are these master plumbers and foundational farmers faring in the open market? Let's check the vital signs revealed by the data:

1. Market Cap: Who's Got the Biggest Plantation?

Market Cap tells us the total market value – essentially, how big the market thinks these Layer 0 'bean farms' are.

The Big Kahunas: Avalanche (AVAX) at $8.7B and Polkadot (DOT) at $6.2B were the clear heavyweights, the 'biggest farms' dominating the Layer 0 landscape back in May '25. They've got sprawling estates.

The Solid Mid-Rangers: Cosmos (ATOM) at $1.68B and Celestia (TIA) at $1.55B formed a respectable second tier – think well-established 'mid-size roasteries' doing brisk business.

Mind the Gap!: Seriously, the scale difference here is wild. The top dogs are magnitudes bigger than the smaller players (like VRA mentioned at $20M). It's like comparing Amazon's distribution network to a single roadside fruit stand. Value is heavily concentrated at the top.

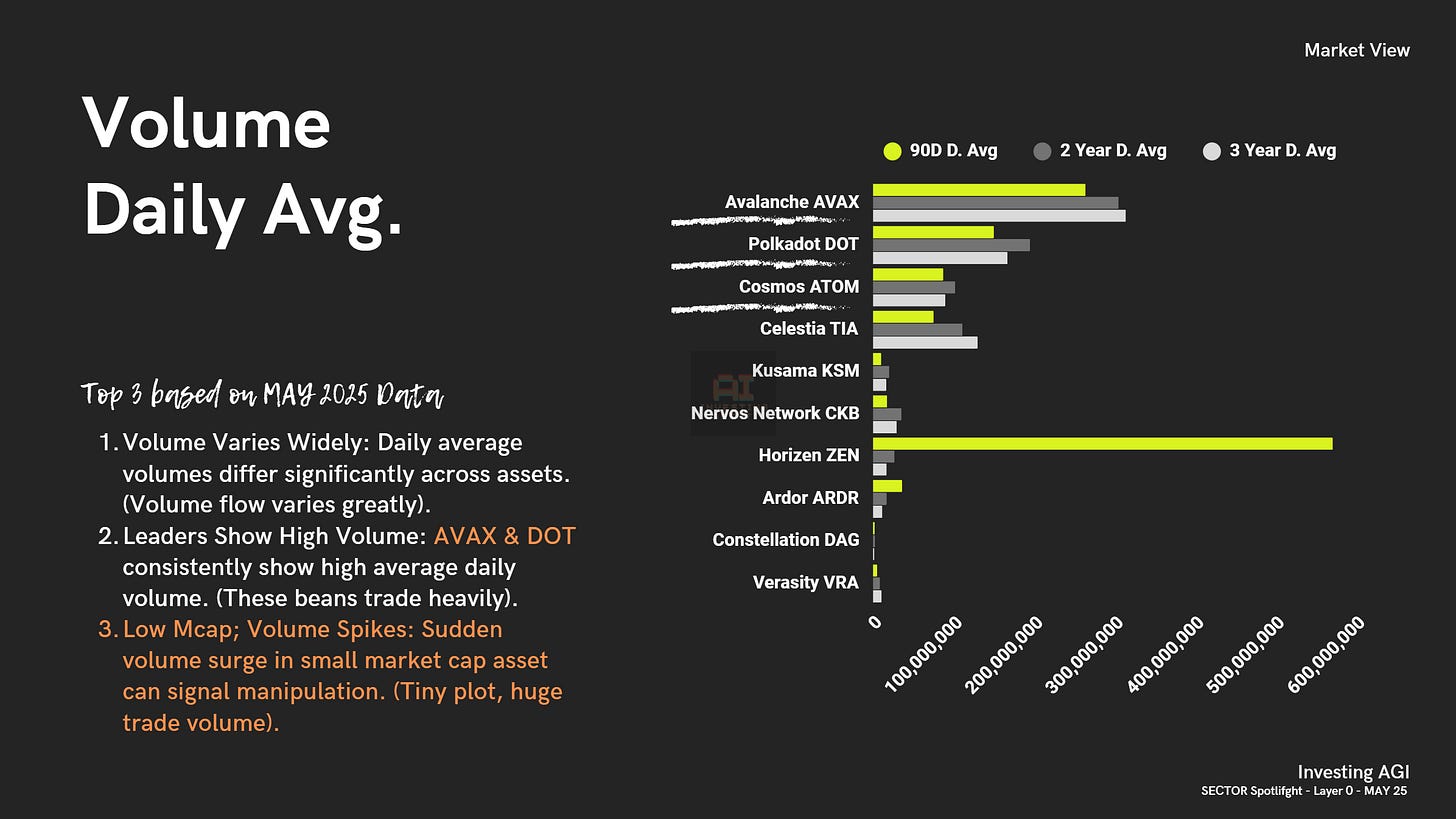

2. Volume (Daily Avg): How Fast Are Those Beans Flying Off the Shelves?

Trading volume shows market activity and liquidity – are people actually trading this stuff, or is it just sitting there looking foundational?

Flow Varies Wildly: The 'volume flow' is all over the place. Some Layer 0 assets trade like hotcakes; others see less action than a decaf appreciation society meeting.

Leaders Lead Trading: No surprises here – the big caps, AVAX and DOT, consistently showed high daily trading volume. These popular 'beans trade heavily', meaning lots of market interest and easier trading.

Caution: Sketchy Spikes: Here's where your Spidey senses should tingle. If you see a 'tiny plot' (low market cap asset) suddenly doing 'huge trade volume' way out of proportion to its size? That can be a major red flag. It might smell less like fresh roast and more like market manipulation. Proceed with caution, or maybe just get your coffee elsewhere that day.

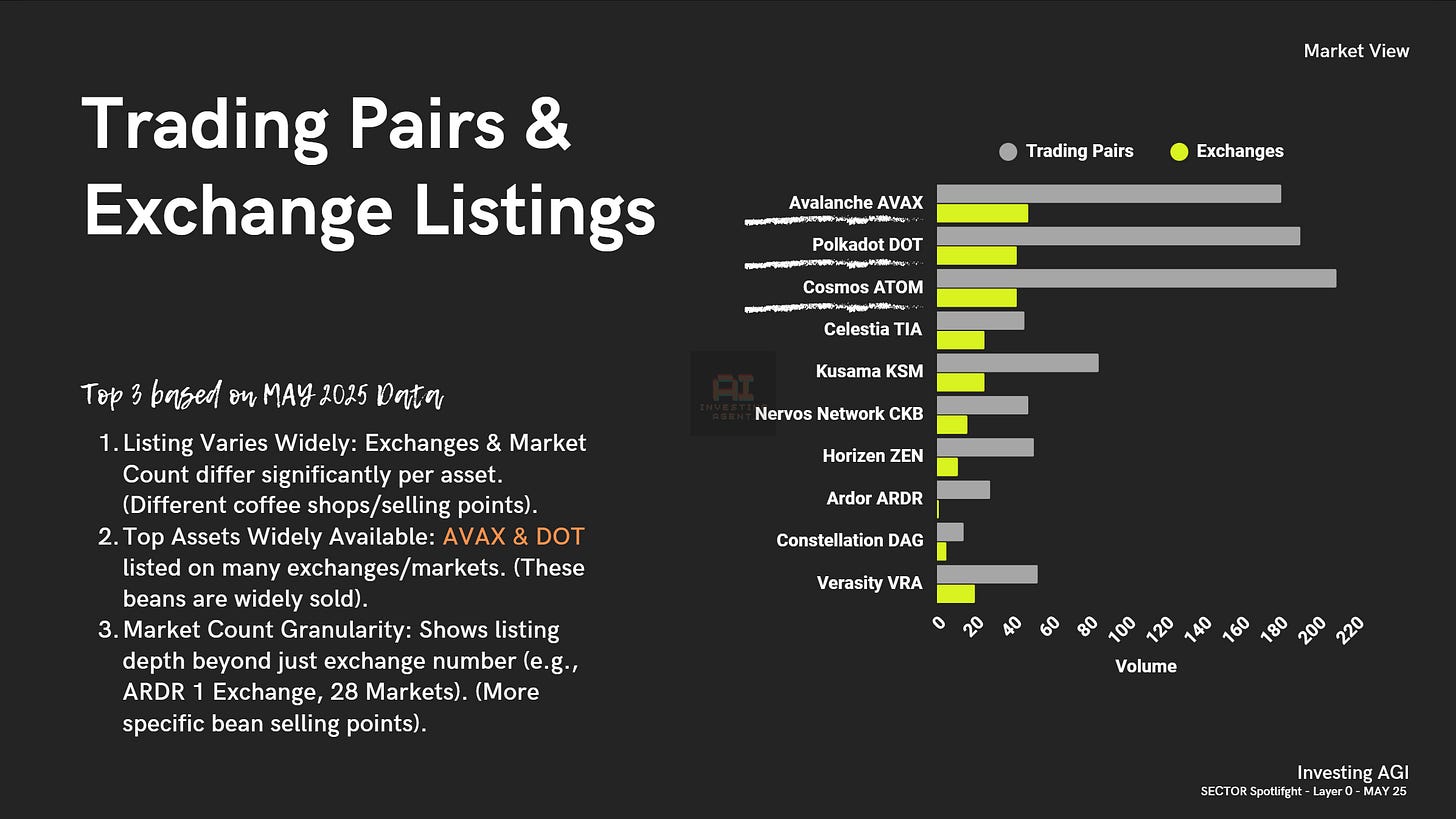

3. Trading Pairs & Exchange Listings: Sold Everywhere, or Just That One Hipster Cafe?

This tells us how easy it is for the average Joe (or Jane) to actually buy or sell these Layer 0 tokens.

Availability Lottery: It's a mixed bag. Some Layer 0 tokens are available in nearly every crypto 'coffee shop' (exchange), while others are more like that obscure single-origin bean you can only find in one specific place.

Big Names are Ubiquitous: Again, AVAX & DOT lead the charge. These foundational 'beans are widely sold' across many exchanges and trading pairs, making them super accessible.

Markets vs. Exchanges: Your research wisely noted the difference between the number of exchanges and the number of markets (trading pairs). A token might be on one exchange (like ARDR) but trade against dozens of different assets (28 markets!). This gives a more granular view of where you can actually swap your beans, revealing all the 'specific bean selling points'.

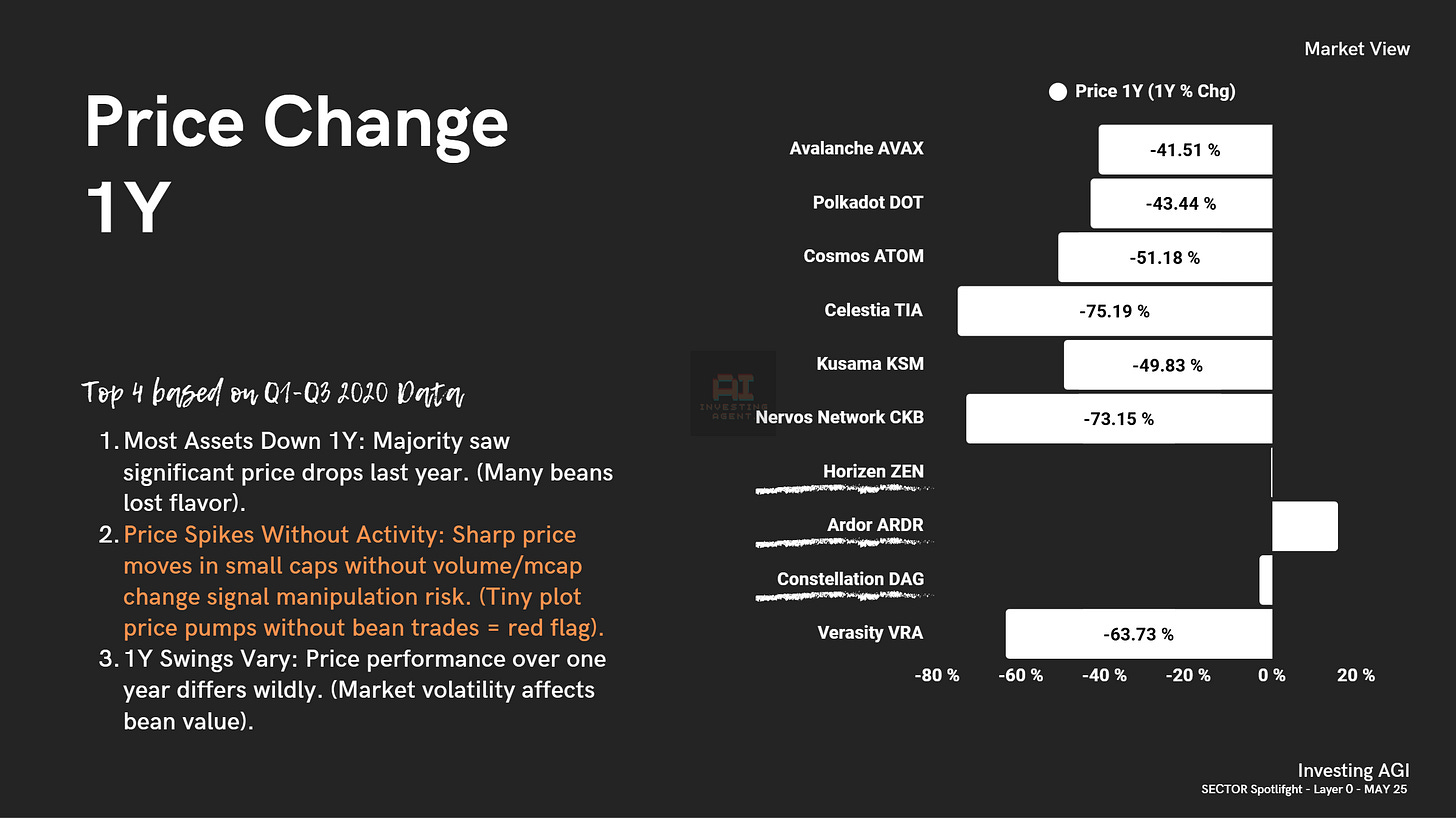

4. Price Change (1Y): Did This Bean's Flavor Appreciate, or Go Stale?

Looking back over a year (from May 2025) tells a story about performance, volatility, and maybe some market indigestion.

Last Year Was Rough: Oof. The data showed most Layer 0 assets took a hit in the year leading up to May '25. Many popular 'beans lost flavor', price-wise, with significant drops noted for AVAX (-41.51%), DOT (-43.44%), ATOM (-51.18%), and TIA (-75.19%).

Volatility Rules: The crypto coaster doesn't spare the foundations. Price swings over the year were dramatic and varied wildly, proving that 'market volatility affects bean value' significantly, even for infrastructure plays.

Beware Phantom Pumps: Echoing the volume warning: if you see a 'tiny plot price pump' – a small-cap token rocketing skyward without a corresponding surge in trading volume or real news – treat it with suspicion. It could be artificial inflation, not genuine demand. Don't get caught holding the bag (of stale beans).

In a market often choked by hype, speculation, and FUD (the 'noise'), focusing on the core market data – the capital concentration, the actual trading flows, the accessibility map, the historical performance – helps us find the real 'signal' for Layer 0 networks. This focused brew aims to cut through that distracting chatter, revealing the market structure beneath the surface narratives. Remember, understanding the foundational plumbing is essential, but true clarity only comes when you filter the noise with data. Stay tuned for more data-driven brews designed to deliver just that!